In a world filled with clickbait headlines and seemingly endless debates about the right time to buy a home, it’s easy to feel like you’re caught in a whirlwind of uncertainty. But guess what? Amid all the noise, there’s one simple truth that stands tall and steadfast: Now could very well be the perfect time for first-time buyers to embark on their homeownership journey. We interviewed seasoned Mortgage Advisor, Anthony Hall, to explore why, despite what you might have heard about mortgage interest rates, the time to buy is now.

Current Market Overview

Let’s start with the big question: Is now the right time to buy? To find out, we’re diving deep into the mortgage market with the guidance of Anthony Hall, an expert with 16 years of experience in the mortgage industry, including 12 years helping Pocket buyers onto the ladder.

What are Mortgage Rates Today?

The last update on the base rate was in September 2023, when the Bank of England maintained it at 5.25%. The base rate remaining unchanged at 5.25% is good news for the mortgage market as new borrowers are boosted by the base rate being held as lenders use the BOE base rate when calculating their stress test rate. When the rate rises this in turn reduces the amount of borrowing available to purchasers. Mortgage borrowers on variable rates or trackers will be breathing a sigh of relief as they will not see an increase in their monthly payments which has gone up 5 times this year!

According to Anthony, “the current mortgage market is, I would say, currently stable.” However, it’s been a journey to this point. Following a rollercoaster ride of interest rate fluctuations, the market has landed on a steadier path. What once felt like financial whiplash due to volatile rates has now evolved into a more predictable landscape. Factors like inflation, the Bank of England’s rate adjustments, and lender responses have all played their part in the market’s ups and downs.

Historical Mortgage Rate Trends

Let’s take a trip down memory lane, shall we? Anthony’s expertise is instrumental in navigating these waters and he highlighted an essential point: the current rates, while seemingly high in today’s context, are comfortably within the historical average. For the past quarter-century, the norm has hovered around 5%. The record-low rates we’ve grown accustomed to in recent years following the 2008 financial crisis were the real anomaly. Yes, we’ve been spoiled by those low rates, but in reality we’re returning to a more typical interest rate scenario, akin to that of 2008 when rates exceeded 7% for some buyers. We’re heading toward a market where 3% to 5% interest rates are the new normal. The good news? We’re not expecting rates to crash anytime soon. It’s all about settling into a healthier, more sustainable range.

What does this mean for the average homebuyer? In Anthony’s words, “if you can afford a mortgage now and get a fixed rate for five years, your rate won’t change during that time.” It’s about securing financial predictability. While the crystal ball remains elusive, the outlook is one of gradual, measured rate increases. The takeaway? Buying a home today, with a manageable fixed-rate mortgage, can set you on a path to financial stability and potential long-term gains. History has shown that property in the UK consistently appreciates, and despite occasional dips in reported growth rates, the underlying value remains robust.

The Downsides of Waiting to Buy a House

Here’s the deal: when you put off buying a home, you’re not just hitting the pause button on homeownership. You’re also missing out on a world of potential benefits. Let’s delve into why waiting might not be the best move.

- First and foremost, it’s all about opportunity. So you’ve got your eye on a brand-new property, and it ticks all your dream home boxes. The catch? New builds tend to have limited availability. So while you’re contemplating your options, someone else might swoop in and claim your ideal property. When it comes to securing that perfect place, hesitation could cost you more than you think.

- Now, let’s talk finances. Renting is like pouring your hard-earned money into a bottomless pit. Every month, you’re handing over your cash without building equity or investing in your future. Plus, there’s the looming spectre of rent increases. As interest rates go up, landlords may decide to pass those costs onto you. So that sweet rental deal you’ve got today might not look so great in the near future.

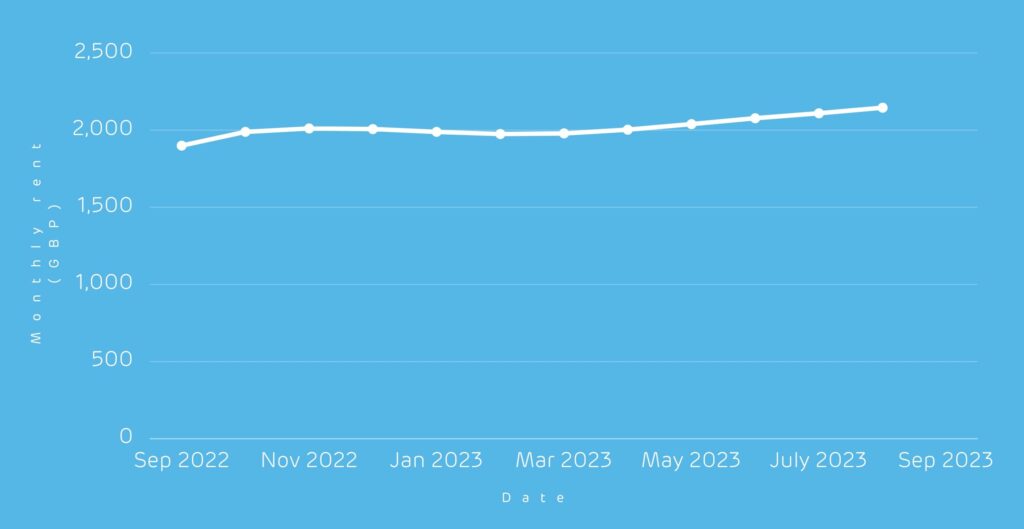

Rents in London have increased by 13.0% compared to last year.

- Security matters, too. Renting means you’re at the mercy of your landlord’s plans. They might decide to sell the property, forcing you to pack your bags and find a new place to call home. That’s hardly the stable and secure future you envision, is it?

- Then there’s the question of interest rates. Anthony puts it bluntly: “We don’t know what’s going to happen definitively with interest rates.” Waiting for them to drop might leave you in a never-ending waiting game. While rates aren’t likely to return to the super-low levels of the past, they’re also not skyrocketing uncontrollably. So the real question is: when do you decide it’s the right interest rate for you? The sooner you start paying down your mortgage, the quicker you’re building equity and securing your financial future.

So, when you consider all these factors, it’s pretty clear – waiting might not be the wisest move. You could be missing out on the perfect property, wasting money on rent, and forfeiting the security and equity that come with homeownership. It’s time to seize the day and embark on your homeownership journey. Your future self will thank you.

Is now the right time to buy for you?

There are a number of things to consider when contemplating if now really is the right time for you to buy.

Anthony stresses the importance of understanding your current financial standing. He remarks, “A lot of people don’t realise that they are in a position to buy because they haven’t been assessed or received proper advice.” The first step he suggests is getting a clear picture of your affordability. Start by creating a budget planner. Analyse your recent pay stubs and bank statements, meticulously documenting your income and expenses. This budget planner becomes your invaluable tool for determining what’s genuinely affordable each month. Anthony recommends, “Look for a mortgage affordability calculator online to assist you in this process.”

Credit Check

In addition to your budget, your credit report plays a pivotal role in the affordability equation. Anthony advises, “Take a close look at your credit history and reports to understand where you stand.” Outstanding commitments, such as car loans and credit card balances, impact your borrowing capacity, which, in turn, defines what you can afford to purchase. Keeping your credit history in check ensures you’re in the best position to secure a mortgage that aligns with your goals.

Life Goals and Needs

Here’s the exciting twist – your decision to buy a home isn’t just about market trends. It’s about your unique life goals and needs. Anthony’s take? “The right time to buy is when you can afford it.” Waiting for the stars to align in the market can be like waiting for a unicorn sighting – uncertain and lengthy. Meanwhile, you could be pouring your hard-earned cash into rent or living in a place that doesn’t quite fit your vibe. So, if your life goals and needs harmonise with homeownership, don’t wait for the market’s permission slip.

The Decision to Wait

Once you’ve conducted your affordability assessment and it aligns with your current budget, the question arises: should you wait for market conditions to shift, or is it time to take the plunge? Anthony offers a clear perspective: “The right time to buy is when you can afford it.” Waiting for interest rates to fluctuate or for headlines to declare an optimal moment can be a protracted, uncertain endeavour. During this wait, you could be spending substantial sums on rent or residing in a place that doesn’t quite suit your preferences. Anthony reinforces the point that “if you can afford to buy, waiting for market changes might not be the best course of action.”

3 Tips for first time buyers

In essence, the decision to buy a home is not solely driven by market dynamics but by your unique circumstances and financial capacity. Anthony suggests, “Speak to experts who understand the intricacies of interest rates and mortgages. They can provide tailored advice and guide you toward a decision that’s right for you.”

- Tip 1: Income Insights

First off, your income – it’s a game-changer when it comes to mortgages. Anthony says, “Different lenders treat your income differently.” If you’re the proud owner of a P60, get it ready. If you’re self-employed, gather those tax overviews and financial statements. And hey, if you’ve got an accountant, give them a shout – they’re like financial wizards for these kinds of things. Understanding how your income plays into the mortgage puzzle is your ticket to making the right moves. - Tip 2: Savings Savvy

Now, let’s talk savings – the magic potion for a hefty deposit. Anthony advises, “Understand how much savings and deposit you’ll potentially have access to.” Whether it’s a generous gift from family or friends, get all the deets lined up. The more you know about your deposit, the clearer the borrowing picture becomes. Plus, it’s like having the answers before the big test – confidence booster, right? Oh, and here’s a pro tip: Check your credit report. Grab one for free from credit agencies, scrutinise it, and if you spot any hiccups, sort them out. Clean credit makes for smooth sailing in the mortgage world. - Tip 3: Budget Brilliance

Lastly, let’s get down to brass tacks – your budget. Anthony’s top advice? “Put together a detailed budget planner.” Knowing how much you can comfortably spend each month is like having a superpower. It not only helps you choose the right mortgage but also lets you explore the mortgage products that are tailor-made for you. So, dive into your expenses and income, and emerge with a budget that’s your trusty sidekick on this homeownership journey.

In the world of real estate, the waiting game often leads to missed opportunities. The current mortgage market is stable, with rates favourable compared to historical trends. Hall emphasises that homeownership offers security, equity, and freedom from the rent cycle, So why wait for the perfect moment if you can make it now?

Visit pocketliving.com and get started on your homeownership journey today. By creating your My Pocket account, you can explore the range of 20% discount, 100% ownership homes tailored for you.